How to Boost Approval Chances

페이지 정보

본문

When it comes to loan application problems with approval, there are several factors that contribute to this outcome. Borrowers often find themselves in a state of despair and confusion after their loan applications are turned down. However, it's essential to understand the reasons behind loan application unapproved loans and how to increase the chances of approval.

Firstly, lenders consider credit scores to assess an individual's eligibility. A good credit score is typically above 600. Borrowers with low credit scores may be considered uncreditworthy, which can result in loan application rejection. To avoid this, individuals should focus on maintaining a good credit score by paying bills on time and reducing debt.

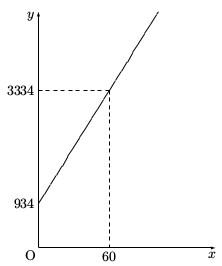

In addition to credit scores, lenders also assess income. They want to know that borrowers can repay the loan with ease and simplicity. This is why borrowers with stable jobs and a steady income have a higher chance of getting approved. Those with unstable income may face more difficulties in securing a loan.

Another critical factor is the loan-to-value ratio. This involves the amount borrowed in relation to the property's market value. Borrowers who apply for a loan with a high LTV ratio are considered highly speculative. In such cases, lenders may demand collateral or higher interest rates. To avoid this, borrowers should focus on saving for a significant deposit to reduce the LTV ratio.

Borrowers should also be aware of the loan term. Longer loan terms may seem more manageable but they often come with hike in interest. In the long run, ソフト闇金スマコンなら即日スピード対応 borrowers end up paying more. Therefore, borrowers should assess their financial situation and choose a loan term that is manageable and realistic.

When applying for a loan, borrowers should also be completely frank about their financial situation. Hiding or misrepresenting information can lead to loan application rejection or even loan default problems. Borrowers should ensure that they disclose all necessary information and avoid any honesty gaps.

Finally, borrowers should understand the lender's requirements and strict regulations. Each lender has its own set of rules and regulations, so borrowers should research and understand these requirements to avoid disappointment and frustration. They should also compare different lenders and loan options to find the best suited for their individual needs.

By being aware of these factors and taking necessary precautions, borrowers can minimize the risk of loan application rejection. A well-planned loan application process and a practical understanding of the requirements can significantly improve the chances of minimal risks.

- 이전글The Sand Water Filter And Our Path To Good Safe Rain Water 25.05.16

- 다음글{Loan Options{ | Education Financing Platforms | Student Loan Resources} 25.05.16

댓글목록

등록된 댓글이 없습니다.